Property taxes are a significant expense for homeowners across the United States. With rates and regulations varying from state to state, it’s essential to understand how these taxes work, especially when you feel your property has been overvalued.

Protesting your property taxes can be a daunting task, but with the right approach, it can lead to a more fair assessment and potentially lower your tax burden.

In this post, I will walk you through the ins and outs of protesting property taxes, providing you with a roadmap to navigate this complex process.

Key Takeaways

- Assess Your Property Tax Assessment Carefully: Understand the details in your annual assessment notice to determine if a protest is warranted.

- Gather Strong Evidence: Collect relevant data such as comparable property values, recent sales, and market trends to support your protest.

- Know the Process and Deadlines: Familiarize yourself with the protest procedure, required forms, and state-specific deadlines.

- Consider Professional Assistance: Hiring a property tax attorney or consultant can enhance your chances of a successful protest.

- Persistence Pays Off: The property tax protest process can be lengthy, but persistence and a well-prepared case can lead to favorable outcomes.

What Does Your Annual Property Tax Assessment Tell You?

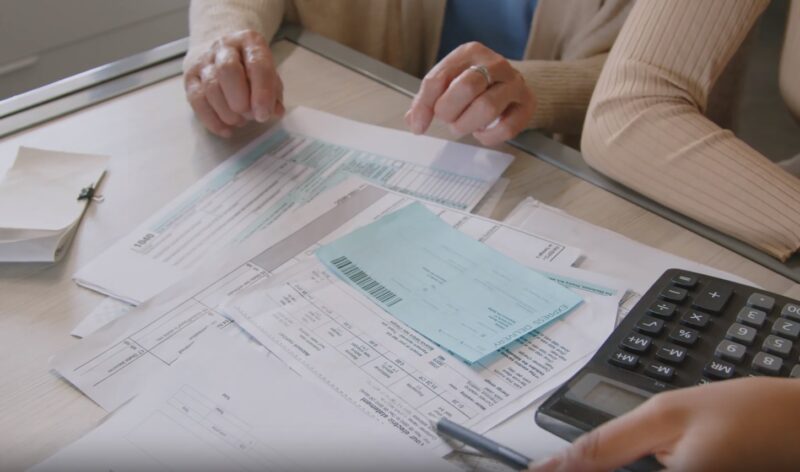

Each year, property owners receive an assessment notice detailing the assessed value of their property and the corresponding tax amount.

This document is the starting point of your protest journey. It’s crucial to understand the assessment’s implications and the factors contributing to the assigned value.

How Can Your Property’s Assessed Value Affect Your Taxes?

Property tax valuations are the backbone of your tax bill.

Imagine this like a puzzle where each piece – your property’s size, location, condition, and local market trends – fits together to form the final picture, which is your property’s value.

The higher the assessed value, the higher your property tax bill.

Preparation Process

Gathering Crucial Evidence

To challenge an overvalued property tax assessment, you need to gather evidence.

This includes your current assessed value, comparable property values, recent sale prices in your area, and any market trends.

Also, consider any improvements or damages to your property that might affect its value.

What Forms Do You Need for a Property Tax Protest?

Familiarize yourself with specific forms like the Notice of Protest and the Request for Informal Review form.

These are your tools for officially initiating the protest process.

Can You Appoint a Representative for Your Case?

Yes, you can. You might consider appointing an attorney or a property tax consultant to represent you.

They can offer valuable expertise and insight into the process.

The Protest Process

What Happens During an Informal Hearing?

An informal hearing allows you to present your case in a more relaxed environment.

This is where you make your initial argument for a revised valuation supported by the evidence you’ve gathered.

The Role of the Appraisal Review Board (ARB)

The ARB is an independent group responsible for reviewing property tax protests. They consider the evidence presented and make binding decisions.

It’s vital to present a well-prepared case to the ARB, as their decision significantly impacts the outcome of your protest.

Receiving the ARB’s Decision

After your hearing, you will receive a written notice of the ARB’s decision. This document is crucial as it determines your next steps.

What If You Disagree with the ARB’s Decision?

If the ARB’s decision is not in your favor, you can further appeal through district court or arbitration.

However, be aware that this can be a costly and time-consuming process.

Tips for a Successful Property Tax Protest

- Understand Local Market Conditions: Being informed about your local property market can significantly impact your success.

- Gather Solid Evidence: The more compelling your evidence, the stronger your case.

- Consider Professional Advice: Consulting with a property tax expert can provide invaluable insights and strategies.

- Stay Organized: Keep all your documents, forms, and evidence well-organized for easy reference during the protest process.

- Be Persistent: The process can be lengthy and challenging, but persistence and a strong case can lead to a favorable outcome.

Regulations and Rates

How Do Property Tax Rates and Regulations Vary by State?

Every state in the U.S. has its own set of rules and rates for property taxes. For instance, New Jersey and Illinois are known for having the highest property tax rates.

It’s crucial to understand the specific regulations in your state to tailor your protest appropriately.

Why Is It Important to Understand These Variations?

Just as a fisherman must understand the tides to ensure a successful catch, a homeowner must understand state-specific tax regulations to effectively navigate the property tax protest process.

This knowledge not only equips you with the right tools but also helps set realistic expectations.

What More Can You Do To Strengthen Your Protest?

Leveraging Market Trends and Comparisons

Understanding local market conditions is like having a weather vane that shows which way the wind blows.

It gives you insight into whether your property’s assessed value is in line with current market trends.

Comparing your property to similar ones in your area, especially those that have been recently sold, can provide a strong foundation for your argument.

The Impact of Property Improvements or Damages

Your property is unique, and its individual characteristics can significantly influence its value. Documenting any improvements or acknowledging damages is essential.

It’s akin to an artist explaining the nuances of their masterpiece – each detail contributes to the overall valuation.

When to Seek Professional Help

Who Can Represent You in a Property Tax Protest?

Hiring a professional, such as a property tax attorney or consultant, can be compared to having a seasoned navigator when sailing through uncharted waters.

They can guide you through the complexities of the process, offering expertise and potentially increasing your chances of success.

How Can Professionals Make a Difference?

They bring a wealth of experience and knowledge to the table, which can be especially beneficial in understanding the nuances of your local property tax system and presenting your case effectively.

What Are the Potential Outcomes of a Property Tax Protest?

A successful property tax protest can lead to a lower tax bill, making it a worthwhile endeavor.

However, it’s essential to approach this process with a realistic understanding of the potential outcomes and the impact they may have on your finances.

How Does a Property Tax Protest Affect Future Assessments?

Winning a protest may influence how your property is assessed in the future.

Like setting a precedent in legal cases, a successful protest can serve as a reference point for subsequent assessments, potentially benefiting you in the long run.

FAQs

Can I protest my property taxes every year?

Yes, you can do it annually if you believe your property’s assessed value is not accurate.

Does renovating my home always increase my property taxes?

Not necessarily. While renovations can increase property value, the impact on taxes depends on the nature of the renovations and local tax regulations.

How long does a property tax protest typically take?

The duration varies but can range from a few weeks to several months, depending on the complexity of your case and local processes.

Are there any costs involved in protesting property taxes?

There might be costs related to hiring a professional for representation or obtaining necessary documentation, but filing the protest itself often has no fee.

Can I still pay my property taxes while my protest is ongoing?

Yes, it’s advisable to pay your property taxes to avoid penalties, even if your protest is ongoing. You may receive a refund if your protest is successful.

Does a successful protest impact my neighbors’ property taxes?

Indirectly, it could. If your successful protest reflects market trends or issues in assessments, it may influence future assessments in your area.

Final Words

Protesting property taxes is a journey that demands diligence, patience, and a strategic approach.

Knowing your assessment, gathering the right evidence, and possibly seeking professional guidance will allow you to present a strong case that may lead to a more accurate and fair property tax valuation.

Keep in mind that a well-prepared case backed by solid evidence is your best ally in this process.

Stay informed, stay organized, and don’t hesitate to seek expert advice when needed.

Your efforts could result in a significant financial benefit and a deeper understanding of property tax assessments and their implications.

Remember to always pay property taxes to avoid problems that may occur, and stay in touch with the latest news regarding this topic.